With home prices recovering and interest rates still low, now may be the time to act. Here are 8 things successful sellers need to know. From: Time.com by Daniel Bortz

0 Comments

When you’re ready to buy a home, you’ll probably remember those three important words we always hear about real estate: location, location, location.

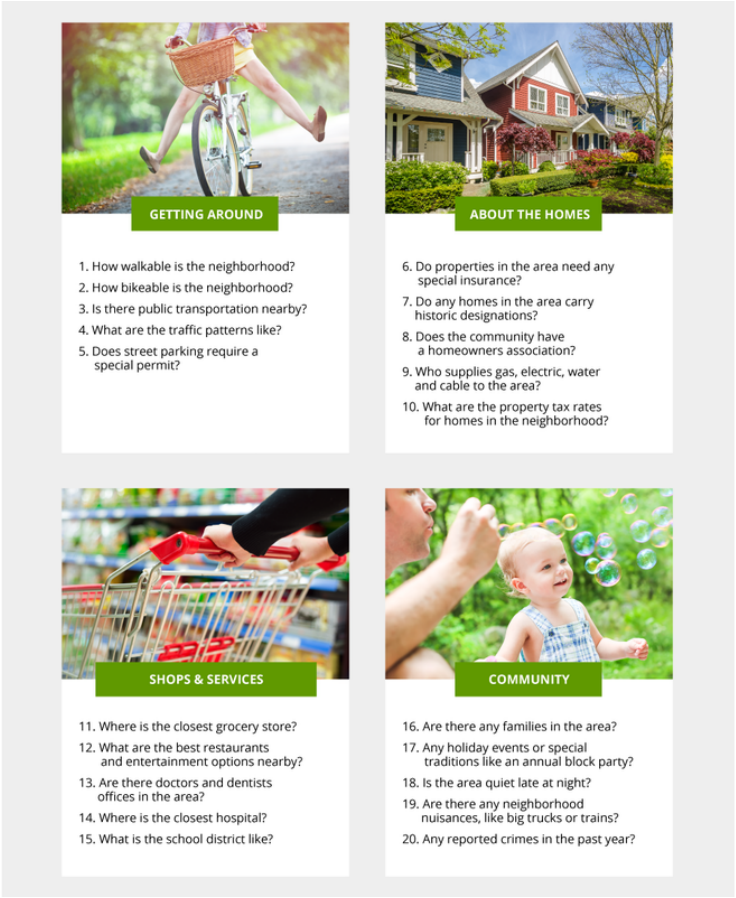

While the geographic location is important, it’s also the amenities around the location that make a house a home. Every buyer is different in what they desire, so you need to find a neighborhood with the location and amenities that fit your desires — and, just as importantly, your budget. Here are 20 questions to ask your real estate agent or new neighbors: When you’re ready to buy a home, you’ll probably remember those three important words we always hear about real estate: location, location, location.

While the geographic location is important, it’s also the amenities around the location that make a house a home. Every buyer is different in what they desire, so you need to find a neighborhood with the location and amenities that fit your desires — and, just as importantly, your budget. Here are a few points to consider, as well as questions to ask your local real estate agent and potential new neighbors. Affordability Location is one factor that will heavily influence the price of a property. You don’t want to shop in locations you can’t afford — even though it might be fun. The first task in your home purchase process is getting pre-approved by a bank or mortgage lender so you understand the ballpark within which you will be playing ball. Inform your real estate agent about your price range so they can identify the locations where you can afford to purchase. Neighborhood type You also need to figure out what works for you when it comes to the type of location you like: urban, suburban, or rural. Many people live in and love high-density areas where retail, restaurants, gyms, and grocery stores are all within a few blocks’ walk. It’s nice to be able to walk to everything — but with that comes lots of cars, people and sometimes noisy neighbors. Other home buyers prefer quieter suburban developments that are probably going to require driving for one’s commercial and entertainment needs. Then there are rural folks who want full quiet and no nearby neighbors. Make sure before you shop that you are shopping in the right type of area for you. School district Schools also make a big difference for many buyers, and a buyer will certainly pay for the best school district. School quality is one of the top items on a parent’s mind when looking for property. You can search the Internet for school ratings and check with the city or county for more information. Of course, if you don’t have children, it’s not as big a deal. What’s next door — or could be You should also always consider what is next door to the property you buy. Will you be living among lots of single-family houses, or big apartment buildings? It’s also important to know if there are currently or once were gas stations or chemical plants nearby. Drive around and look, plus check Natural Hazard Reports to see what is or was in the area. Additionally, be cautious about empty developable lots or empty retail/warehouse properties nearby, as you never know what might end up being built there. It’s also smart to understand the zoning on your property, as it might let the single family home next door be torn down and developed into a 4-plex rental property. That might or might not be okay with you, but you should be aware if it’s a possibility. Holdability One more important item to consider regarding location is your chances of owning the property a long time. If you are not sure you’ll be happy staying a while, you’re better off passing on buying for the time being. Considering all these issues — as opposed to making a quick purchase decision based on what your heart is telling you — should help you buy a home that is a good fit, will serve you well, and will be a good investment for your future. Source: Zillow.com Buying Your First Home – 5 Tips There are few purchases more exciting, and more unnerving, than the purchase of your first home. You probably have a lot of anticipation about the possibilities in front of you, and a bit of trepidation about the mortgage and buying process. Fortunately, you are not alone in your hopes and fears. Every first-time home buyer goes through what you are going through, and most of them make it through the process successfully! Over my twenty years as one of the top real estate agents in Medway MA, I have emphasized to my clients that the biggest obstacle in front of them is education on what it takes to buy a home. The following tips will provide you with a good start on the process, and point you in the right direction for where you can dig deeper, and learn what you need to learn, to be a successful home buyer. Learn About Your Credit Unless you are fortunate enough to have a substantial savings or income from some outside source, chances are you are going to need to get a mortgage to buy your first home. The financing process is complex and challenging for most people when they first go into it, but if you find the right lender that is willing to help you understand your options, it does not have to be overwhelming. However, you will discover that your mortgage options center around your credit. You need to learn what goes into your credit score, and how you can change that score, to get the best mortgage options – or any mortgage at all. There are plenty of resource out there that can teach you about your credit. You want to know what your credit score is, but it is even more important that you know what affects that score. You may get pre-approved for a mortgage, but if you do something to knock your credit score, you could find that you are denied when you actually go to get the money for your home. If you discover that your credit is not as great as you need it to be, take heart. You can repair it and get yourself in a good position. It will just take time, patience and discipline. By learning about your credit now, before you ever start home shopping, you will be taking care of the biggest factors in your home buying process. Once you own your first home it is critical to understand how one missed mortgage payment can affect your credit score. Keeping your credit in the best possible shape is always a smart consideration as it is a major factor in the interest rate you get on every major purchase that's financed. Get pre-approval For a Mortgage It only makes sense to learn what you can spend before you start house hunting. By going to a lender, or talking to several different lenders, you can get an estimate on what amount you can get for a loan. When you know what your mortgage options are, you can then shop for homes within your price range. Keep in mind that different lenders offer different options, so it is worthwhile to shop around for a bit and see if you can find one that offers you the ideal mortgage for your needs. Find a Realtor That is a Good Fit While you can certainly look through listings and shop around for a house on your own, you will quickly find that house hunting can become overwhelming and exhausting. There is so much to learn and so many mistakes you can make – costly mistakes – that hiring a Realtor will seem like the most obvious way to increase the efficiency of your buying process and to protect yourself. But don't just go out and hire any Realtor. Like any job, there are some people that are great at real estate, and some that just want your money. You should interview three or four Realtors, get references from recent clients, etc. Kyle Kiscock, a Real Estate agent from Rochester NY, does a great job explaining how to interview a buyers agent. You want to ask about not only how many homes the Realtor sells, but what price they sell for. You want an agent that knows how to price a home right the first time. The better the agent you hire, the better your home buying options are going to be. Know What You're Looking For There are so many houses out there for sale. Just deciding you want a 3-bedroom is not enough to help you make sure you buy what you actually want. You need to take some time and consider all the things you want in a home, including location, size, amenities, etc. It can be helpful to think about what you want to use the home for – working on cars, doing art projects, raising children. When you have a detailed description of what you want - both what is a necessity, and what you would really like to have – then you can talk to your Realtor and get an idea of your options. Chances are you won't be able to have it all, but you can often get close if you know what you are looking for. Be Financially Prepared Owning a home is more costly than many first-time buyers realize. There is no landlord to fix the broken water heater, for instance. You need to not only have enough money for the down payment and to pay the mortgage, but also to deal with possible emergencies. Talk with your real estate agent about how much you should have set aside for emergencies based on the type of home you are going to purchase. Real Estate agents like to call this being fiscally responsible when buying a home. It is okay if you don't have a huge savings to deal with every eventuality, but you do not want to be one of the first-time home buyers who has nothing set aside should something go wrong. Even a small savings can make a major difference, and help you avoid going into further debt, if you need to fix something in your new home. From: Mortgages.com By Bill Gassett

Months after Superstorm Sandy wreaked historic destruction on the Jersey Shore, Kevin, Norm and Richard find three homeowners determined, despite the seemingly insurmountable challenges, to stay and rebuild: stronger, smarter, and up out of harm's way. In Bay Head, Point Pleasant, Manasquan, and communities like them along this hard-hit barrier island community, there's nowhere to go but up. |

Tress RealtyTress Realty Group compiles some of the best real estate news, tips, and information for buyers, sellers and investors. Archives

April 2020

Categories

All

|

Home

Use of the information and data contained within this site or these pages is at your sole risk. If you rely on the information on this site you are responsible for ensuring by independent verification its accuracy, currency or completeness. It is provided “as is” without express or implied warranty.

Some properties which appear on this web-site may no longer be available because they are under contract, have been sold or are no longer being offered for sale. Images uses for navigation may be for properties in different towns, and are not intended to be considered anything other than representative of the types of houses that may be found in a particular municipality. All data and/or search facilities on this site are for consumer's personal, non-commercial use and may not be used for any purpose other than to identify prospective properties that consumers may be interested in purchasing.

Tress Realty Group cannot guarantee the accuracy of the IDX/MLS data created by outside parties. Tress Realty Group further assumes no responsibility for any misleading content or incorrectly listed information due to such negligence. All ancillary information presented on this web-site is not guaranteed and should be independently verified by the users of this site. Tress Realty Group makes no warranty, either expressed or implied, as to the accuracy of the data contained within or obtained from this web-site.

Tress Realty Group accepts no liability for any interference with or damage to a user’s computer, software or data occurring in connection with or relating to this Site or its use or any website linked to this site. Further, Tress Realty Group has provided Hypertext links to a number of sites as a service only. This should NOT be taken as implying any link between us and those various organizations or individuals.

Disclaimer: this website may be supported by ads and participation in affiliate programs. We may earn a commission when you click our links. The information included in this post is for informational purposes only and should not be taken as legal or financial advice.

Site copyrighted by Tress Realty Group LLC © 2016-2022, all rights reserved.

RSS Feed

RSS Feed