|

Sales of million-dollar homes are softening.

It's not a correction, experts caution, just something of a breather brought on by volatility in the U.S. stock market and an oversupply of luxury homes. Sales of homes priced above $1 million fell 4 percent in July from a year ago, according to the National Association of Realtors. Activity is far more robust at the entry level and middle of the market, thanks to a drop in mortgage interest rates and pent-up demand. Luxury, however, doesn't rely on mortgages so much, but is far more sensitive to financial markets.

0 Comments

When Marjon Dean started searching for a new home in the New Jersey suburbs, she first armed herself with data on the top-ranked public schools in the state.

Taking that information into account, as well as access to public transportation and commute times to New York City, Dean narrowed the list of options for her family's move to four towns: Summit, Chatham, Millburn and Westfield. Dean and her husband bought a property that was built in the 1920s and that needed work in the Short Hills section of Millburn in October. The price was $814,000, roughly the same amount the couple received in the sale of their similarly-sized but newer home in the Boston suburbs, Dean said. With all the activity happening along the Manhattan side of the Hudson River—the World Trade Center, Hudson Yards, and the like—it can be easy to forget that there's a slew of construction projects happening on the other side of the water.

But there is, in fact, a veritable building boom in New Jersey right now, particularly the stretch along the waterfront between Fort Lee (to the north) and Bayonne (on the southern end). The developments going up run the gamut from small rental buildings to the state's soon-to-be-tallest skyscraper, and each will have a part in transforming the state in the next few years. Click here for the map of more than 30 of those projects. Source: Curbed.com Spencer Rascoff, Zillow Group CEO, speaks about the state of the housing market in the U.S. at the iCONIC Conference in Seattle. If you're entering into the real estate market for the first time, you'll hear the old adage: location, location, location. That's three of the key factors... I'm kidding but, location is, indeed, a very important concern. However, many buyers think location is most important because of the surrounding area. So, if the neighborhood is nice, with parks, good schools, retail stores nearby, and somewhat close to freeways, it's a good location. But what also makes it a good location is how close it is to your work. These days many people are telecommuting, which allows them to work from home and save gas. If that's the case, a 45-minute or hour-plus drive, one-way to the office, might not be too intimidating because you're not going to have to do it every day. But your long commute could still become a key factor when it comes to getting a mortgage. Some lenders may factor in your long commute as part of your overall debt-to-income ratio, (DTI) which will directly impact how much money you can borrow. Regardless of whether the lender takes your extended commute into consideration, buyers should. With rising gas prices and increasing traffic, an extra long commute to the office can hurt your pocketbook. A study from the Center for Housing Policy and the Center for Neighborhood Technology reported that transportation expenses for households in the largest metro areas increased 44 percent from 2000 to 2010. And about 600,000 full-time workers have a huge commute of at least 90 minutes and 50 miles to get to the office, according to U.S. Census data. Sometimes the allure of rural areas with typically less expensive housing prices is so strong that buyers forget to consider how long they'll be on the road before they're home at night. They also don't factor in the gas costs that add up fast and can amount to hundreds of dollars in expenses each month. If you do purchase a home with a long commute, talk to your company about possible commuting subsidies, arrange a carpool, or try to work remotely more frequently to reduce the back and forth commute. Craigslist.com and eRideShare.com help connect people with others who live and work nearby. Some cities even have their own sponsored program for free online matching services for carpooling. You can also ask your work to adjust your hours so that you can come in and leave at times when you'll miss rush hours. This way you're not just burning gas while sitting in tight, slow-moving traffic. Cities with good mass transit are attracting buyers and providing options that help avoid putting extra unwanted miles on their vehicles. It makes sense. Sometimes the commute, if they don't have to drive, is a welcome break giving workers time to catch up on a good book, movie, or extra work. Plus, some cities have waterway ferries that make it a beautiful and enjoyable commute. If you're shopping for a home and considering the long commute, spend a little time weighing the pros and cons. Also, do a little research. You can visit commutesolutions.org to use their online calculator to determine the true cost of your driving commute. Having a road map that shows your expected expenses will help you accurately budget for them. Source: realtytimes.com

As you get ready to sell your home, you may discover the need to make numerous repairs and updates. But when do you have the time? Most jobs you can do yourself, but others require a little more skill. Maybe it's time to consider hiring a handyman. According to Angie's List, hiring a handyman can prevent waste and overcharging, as the handyman will only charge you for hours worked. Plus they keep their rates low with low overhead and by not having to pay other workers. A handyman is someone who can handle small painting and carpentry jobs that can be completed quickly. He typically works alone, charges by the hour plus materials, and in some states is required to be licensed and carry insurance. If you think you're going to more extensive work, you should consider a contractor. A contractor differs from a handyman by taking larger jobs that require going behind walls, or tearing out and rebuilding areas. Contractors supervise specialized tradespeople such as plumbers, electricians, and craftsmen. Before you hire a handyman or a contractor, make a list of the jobs you need done. If your list is composed mostly of repairs and some updating like painting, a handyman should suit your needs. To hire the right person for the job, do the following: 1. Get recommendations from family, friends, or your real estate professional. She may know an individual or company that specializes in "make-ready," a room-by-room clean-up, touch-up and fix-up. You can also contact sites such as HomeAdvisor or Angie's List, to hire workmen. 2. Interview several handymen before making your decision. Make sure the handyman you hire has the experience and equipment to do the jobs you need and is willing to guarantee the work. 3. You want someone you'll feel comfortable having around your family and in your home. Hire only personnel who are bonded and insured. 4. Inspect the work while it's in progress and when it's finished. Most professionals want to do a good job out of pride of workmanship. Handymen also rely heavily on referrals, so if you're pleased, you'll recommend the handyman to your family and friends. What you don't want to do is leave small repairs undone. Home buyers notice if maintenance has been ignored, and may conclude the home needs greater repair than it actually does. Source: realtytimes.com

The location of your home, its construction and its condition all play a part in how much you pay for home insurance. Insurance companies assess risk in different ways, so it's important to compare homeowner insurance quotes to be sure you get the most affordable rate. "It's about knowing your risk, and what you can do to minimize that risk," says Lynne McChristian, Florida representative for the Insurance Information Institute. Here are seven factors that influence your home's insurance rates. CLICK HERE FOR THE SEVEN FACTORS. Source: MSN.com

Owning a home can be a smart financial move, but is it right for you, right now? It’s happening all across America right now: Hordes of renters, innocently perusing their social media accounts, are noticing a theme. It’s not that everyone is getting married or obsessing over spiralized vegetables — they’re posting pictures of newly purchased homes.

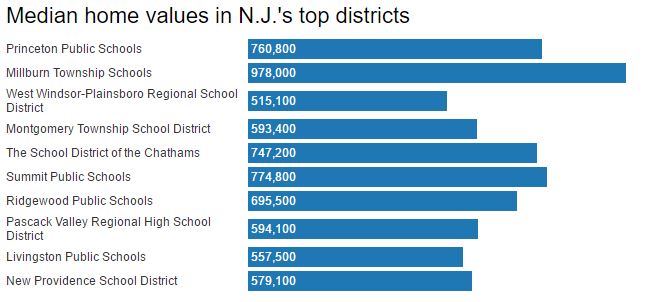

But like your mother always said, just because everyone is doing it doesn’t mean you should — or should you? There are certainly pros and cons of becoming a homeowner, and stumbling across just one dreamy listing of a home for sale in Anaheim, CA, with the perfect open-concept kitchen and fenced-in backyard can leave you thinking about little else. But then you realize you’d rather save your money for a travel adventure, and said dreamy house doesn’t come with the amenities you love at your apartment, like an on-site gym, pool, and doggie day care. Don’t jump the gun and assume you need to buy a house. Here’s some truth talk: You might not be ready to buy. Pay attention to these seven signs that reveal that even if you think you’re ready to buy a house, you might not be. Financial expert Peter Dunn details how young people can fix their finances and become independent without being a burden to their parents. Douglas Elliman's Fredrik Eklund, star of Bravo's “Million Dollar Listing," discusses Brexit's positive impact on U.S. real estate. It’s well known that homes in good school districts sell for a premium—and are a good investment for buyers with or without children. But just how much can you expect to top up that listing price or bid? And what are the top school districts where people are rushing to buy homes—regardless of the cost?

The economic research team at realtor.com® took up the challenge and dived into the data. The team compared homes in school districts rated 9 or 10, the highest score, by GreatSchools.org with homes in nearby districts rated 6 or less. “It’s common knowledge that buyers are often willing to pay a premium for a home in a strong school district,” says Javier Vivas, research analyst for realtor.com. “Our analysis quantifies just how good it is to be a seller in these areas.”  So, you've decided to buy a home. You're leaving the world of renting behind and investing in an asset you'll come to cherish, but before you start researching homes, you'll want to make sure your finances are in tip-top shape. After all, it's next-to-impossible to pay for a home if your credit is in the gutter and/or you can't afford a down payment. With those factors in mind, here's a financial to-do list that will make the home-buying process easier. CLICK HERE FOR THE FULL STORY AT MSN.COM  Perhaps your home is looking a dated. A major renovation is beyond your budget, but you can still perk up your home’s appearance. Luckily, a number of inexpensive do-it-yourself projects will give your home a whole new look. And some don’t even require DIY skills. Decluttering and deep cleaning can freshen up your home without any cost but your time. Changing bedspreads, towels, shower curtains and window treatments can make a big difference with minimal time investment. Adding accessories such as throw pillows and art can also provide a new look. CLICK HERE FOR THE RENOVATION IDEAS FROM MSN.COM. If your child is looking to buy a house and can't qualify on their own, you may have thought about consigning on a loan. "It can be a brutal world out there, and you want to help someone you care about. That's a perfectly reasonable argument," said US News.

But have you examined the potential consequences of this action? Your good intentions could end up costing you, so you might want to ask yourself a few key questions before you sit down at the closing table. What's the plan? It's a good idea to examine the goals here - both yours and the recipient of your kindness. Is this house a long-term investment that will be on your credit for a long time? A short-term thing that's only intended to help establish credit for your child? A moneymaking venture that could pay off for both of you after you flip the house? Knowing the plan can help you make the best decision. Is your child responsible? What have you observed about your son or daughter's financial responsibility. Do they have a lot of outstanding credit they're not managing well? Do they regularly borrow money without paying it back? Do they buy a lot of unnecessary items instead of being more prudent with their money and establishing some solid savings? These could all be red flags. Buying Land to Build a New Home  by Elizabeth Weintraub, Lyon Real Estate in Sacramento, California. Whenever I discuss buying land with my real estate clients, I can't help but hear the theme song for that 1960's TV show ringing through my head: "Green acres is the place for me." Laugh as you may, urban dwellers often idealize what it's like to live on acreage outside city limits. So before you decide to dump it all for "give me that countryside" and buy land on which to build your dream home, consider first the realities. The things that could cost you big-time after closing...  By Elizabeth Weintraub Whenever I discuss buying land with my real estate clients, I can't help but hear the theme song for that 1960's TV show ringing through my head: "Green acres is the place for me." Laugh as you may, urban dwellers often idealize what it's like to live on acreage outside city limits. So before you decide to dump it all for "give me that countryside" and buy land on which to build your dream home, consider first the realities. The things that could cost you big-time after closing.... It's a good bet that more than a few California real estate agents don't know that the standard purchase form -- The California Residential Purchase Agreement (RPA-CA) -- is an "as is" contract. To be sure, the fact is somewhat buried, but there it is, in not-bold print, in section 11 on page 5 (of a 10 page contract), under Condition of Property. It says this: "Unless otherwise agreed in writing: (i) the Property is sold (a) ‘AS-IS' in its PRESENT physical condition as of the date of Acceptance and (b) subject to Buyer's Investigation rights; (ii) the Property, including pool, spa, landscaping and grounds, is to be maintained in substantially the same condition as on the date of Acceptance; and (iii) all debris and personal property not included in the sale shall be removed by Close of Escrow." So, absent any other agreement to the contrary, saying the sale is "as is" doesn't mean the seller can stop watering the lawn. Nor is it OK to leave the rusting frame of the trampoline in the back yard. It is important to note that the "as is" clause allows for agreed-upon repairs or work to be done. For example, the parties may, somewhere else in the contract, have agreed that the seller will provide corrective termite work that is needed. Other than that, the sale is "as is". Moreover, the "as is" provision also allows that the buyer retains his inspection rights. If the buyer's inspection uncovers some condition that needs repair, he can still ask for that to be fixed. Of course the seller can say ‘no'. The buyer may then cancel; but he won't have breached. The presence of the "as is" clause does not, of course, eliminate the possibility of ambiguity or misunderstanding. Suppose an offer is written, using the RPA-CA form, and the only request made by the buyer is "Seller to paint the barn door." The seller then gives a counter offer with only two provisions: 1. An increase in the price; and 2. The statement, "Sale to be As Is". The buyer accepts the counter offer. Some weeks later, shortly before closing is due, the buyer asks the seller when he is going to paint the barn door. The seller replies that he is not going to paint the door; the sale, after all, was "as is." But, the buyer replies, "your having said that in the counter offer was just a redundant reiteration of Section 11. It was ‘as is' with the exception of any written agreements to the contrary. You accepted the offer without specifically rejecting the request to paint the barn door, so you are obligated to do it." (First of all, we all know how this is going to turn out. A real estate agent, or two, will put up the money to have the door painted. But that is beside the point.) It is pretty clear that, at the point of accepting the counter offer, there was not a true "meeting of the minds." When that occurs, it is often not immediately apparent. If it is, steps should be taken to reach clarification. No one should be blamed for missing the need for clarification. But we can all learn that, when an "as is" clause is in play, we want to be sure that all parties understand what is intended. Bob Hunt is a director of the California Association of Realtors®. He is the author of Real Estate the Ethical Way. His email address is [email protected] Source: realtytimes.com

The idea of renovating your bathroom can be overwhelming, but you don't have to knock down walls or gut the whole thing to make it feel new again. Making smart updates can get you closer to the look you want without the big budget, or the big hassle.

"You dream about a bathroom that's high on comfort and personal style, but you also want materials, fixtures, and amenities with lasting value," said houselogic. "Wake up! You can have both." Here are a few places to start. 1. A new showerhead This is one of our favorite ways to freshen up a bathroom because a new showerhead is: A) inexpensive, even for one that provides multiple heads and functions; B) an easy way to make your shower more enjoyable if you've been dealing with an old showerhead that doesn't provide massage or handheld options; and C) also a money saver since new showerheads are more energy-efficient. 2. Soaker tub Soaker tubs are the hottest trend in bathrooms right now, and it's getting to the point where anything else makes your bathroom look outdated. Have one of those giant Jacuzzi tubs in your bathroom? It's probably time to yank it out, especially if your jets stopped working long ago. The bonus of a freestanding tub is it can also make your bathroom feel airier and more spacious. Sales of parcels for development are plummeting, with only 48 land deals completed in the first half of 2016 compared to 79 in the same period of 2015New York’s condo slowdown is upending the market for one of the most coveted assets in tightly packed Manhattan: land.

Sales of parcels for development are plummeting as builders, seeing signs that a once-hot property market is cooling, offer prices that sellers won’t agree to. Just 48 land deals were completed in the first half of 2016, compared with 79 in the year-earlier period and 73 in 2014, according to brokerage Ariel Property Advisors. That may be a sign of a broader real estate slowdown to come, since land is often a leading indicator for the rest of the market. |

Tress RealtyTress Realty Group compiles some of the best real estate news, tips, and information for buyers, sellers and investors. Archives

April 2020

Categories

All

|

Home

Use of the information and data contained within this site or these pages is at your sole risk. If you rely on the information on this site you are responsible for ensuring by independent verification its accuracy, currency or completeness. It is provided “as is” without express or implied warranty.

Some properties which appear on this web-site may no longer be available because they are under contract, have been sold or are no longer being offered for sale. Images uses for navigation may be for properties in different towns, and are not intended to be considered anything other than representative of the types of houses that may be found in a particular municipality. All data and/or search facilities on this site are for consumer's personal, non-commercial use and may not be used for any purpose other than to identify prospective properties that consumers may be interested in purchasing.

Tress Realty Group cannot guarantee the accuracy of the IDX/MLS data created by outside parties. Tress Realty Group further assumes no responsibility for any misleading content or incorrectly listed information due to such negligence. All ancillary information presented on this web-site is not guaranteed and should be independently verified by the users of this site. Tress Realty Group makes no warranty, either expressed or implied, as to the accuracy of the data contained within or obtained from this web-site.

Tress Realty Group accepts no liability for any interference with or damage to a user’s computer, software or data occurring in connection with or relating to this Site or its use or any website linked to this site. Further, Tress Realty Group has provided Hypertext links to a number of sites as a service only. This should NOT be taken as implying any link between us and those various organizations or individuals.

Disclaimer: this website may be supported by ads and participation in affiliate programs. We may earn a commission when you click our links. The information included in this post is for informational purposes only and should not be taken as legal or financial advice.

Site copyrighted by Tress Realty Group LLC © 2016-2022, all rights reserved.

RSS Feed

RSS Feed