Fixer uppers can get expensive. If buying a fixer-upper is your next big money move, make sure you’re not settling for something that’s going to cost you much more than you planned. Buying a house in need of repair can mean ample savings in the short term but a potential significant investment in the long term. If you don’t know how much it’s going to cost to fund all of those renovations, you might be diving right into a money pit. Ideally,your budget for repairs and renovations should have 10 percent to 20 percent tacked on for unforeseen problems. Run into these problems, though, and your budget could go well over that. Here are six signs you’re moving into a money pit.

0 Comments

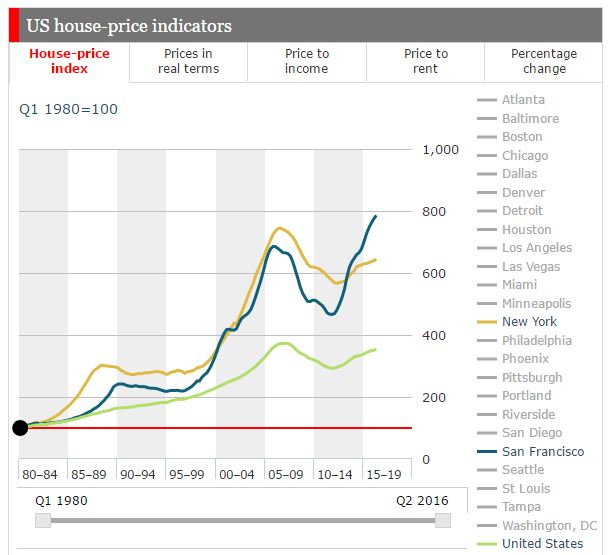

There are many smart, simple ways to fix up your basement in order to create a safe, enjoyable space for friends and family. No space in your home is more accommodating and homey, or conversely scary, than your basement. A nicely finished basement can be the entertainment centerpiece of your entire home, housing your big-screen TV, the most comfortable couches in the place and a warm, inviting atmosphere that wraps each guest in comfort. But, if your basement is unfinished or has other lingering issues, it can be a downright scary place to spend any amount of time. Here are a few simple tips to help you fix your basement:  Home prices in the New York area ticked up slightly over the last year but increased at a slower rate than 19 other major metropolitan markets in the country, according to a new report released on Tuesday. The S&P CoreLogic Case-Shiller 20-City Composite index notched a 5 percent year-over-year increase in July led by big gains in real estate values in the Pacific Northwest, specifically Portland and Seattle. The New York region, including northern New Jersey, saw home prices rise just 1.7 percent over that same time frame, the weakest growth among all of the cities included in that index. Sales fell 7.6%.New U.S. single-family home sales posted their biggest decline in nearly a year in August after soaring to nine-year highs the month before, with analysts saying the trend in sales remains positive.

The Commerce Department said new home sales fell 7.6% to a seasonally adjusted annual rate of 609,000 units last month. Sales were up 20.6% from a year ago.  Although your homeowner's insurance may seem like an unnecessary expense at times, it is an invaluable safeguard. Property and casualty risk research firm ISO -- Verisk Analytics states 5.3 percent of all insured homes made a claim in 2014. In addition, the Insurance Information Institute (III) and SNL Financial reported that the incurred losses for homeowner's insurance in the United States totaled $39.84 billion in 2014. This data indicates that even though only a small percentage of homeowners submit home insurance claims, the overall costs associated with these claims can be substantial. Clearly, home insurance can make a world of difference for homeowners, but that does not mean you should be forced to break the bank to find the proper coverage. If you understand the factors that impact your home insurance, you should have no trouble picking up the right coverage at the right price. Ultimately, you'll be able to insure your home against a wide range of risks for a reasonable cost. Here's a closer look at three factors that have the biggest impact on your home insurance  After spending hundreds to thousands of dollars on landscaping, how do you know if you'll recoup your investment? Homeowners may wonder if their efforts are worthwhile compared to interior projects. In actuality, landscaping comes back in resale value more than you may think. According to a publication from Virginia Tech, a home landscape has been valued at around 15 percent of a home's total value. Furthermore, certain landscape aspects add more to the home than others, including:

Here is more information about these elements and how to increase the value of your home. Besides the obvious factors, there are some quirky elements that can affect your home’s value. Find out what they are. Surprise! You might know more about real estate than you think. For example, you know that square footage, number of bedrooms and bathrooms, lot size, and location determine home value: A 4,000-square-foot, five-bed, five-bath beachfront home for sale in Miami, FL, will almost always be worth more than a 2,000-square-foot, two-bed, two-bath home on a quarter-acre lot 20 miles inland. But those obvious factors aren’t everything you need to calculate your home’s property value estimate. Other, less obvious features can negatively or positively come into play — features you might not have considered. Here are eight frequently overlooked (and not always fixable) things that, for better or for worse, can impact the value of your home. Yet 548,000 U.S. Homeowners Regained Equity in Q2 of 2016 Irvine, Ca-based CoreLogic is reporting this week that 548,000 U.S. homeowners regained equity in Q2 2016 compared with the previous quarter, increasing the percentage of homes with positive equity to 92.9 percent of all mortgaged properties, or approximately 47.2 million homes. Nationwide, home equity grew year over year by $646 billion, representing an increase of 9.9 percent in Q2 2016 compared with Q2 2015.

In Q2 2016, the total number of mortgaged residential properties with negative equity stood at 3.6 million, or 7.1 percent of all homes with a mortgage. This is a decrease of 13.2 percent quarter over quarter from 4.2 million homes, or 8.2 percent, in Q1 2016 and a decrease of 19 percent year over year from 4.5 million homes, or 8.9 percent, compared with Q2 2015. Click to continue reading at World Property Journal But as The Big Short showed, you don't want to jump on the bandwagon just yet.House flipping. the practice where the same home is sold twice in a 12-month period, is at a six-year high, according to data from RealtyTrac.

Over 51,000 single family homes and condos were flipped in the second quarter of 2016, 14% more than in the first quarter and 3% higher than a year ago and the most overall since 2010. Almost 40,000 investors flipped a house in Q2, also a six-year high. Why is house flipping back in vogue? If your walls could talk, they might say, “Don’t paint me lime green.”  If you’ve ever wondered what went on behind closed doors in your city, a look through local real estate listings might give you the answer: unfortunate paint color choices, rooms with enough clutter to supply a yard sale every weekend, and an almost universal obsession with granite countertops. And those are just the homes on the market, which should at least be trying to make their best impression. Our homes may be a reflection of ourselves, but this philosophy can backfire when you’re putting a property up for sale. “What a seller likes may be too personal for a buyer,” says Jennifer Kjellgren, broker and owner of Intown Expert, an Atlanta, GA, real estate firm. If you’re about to enter the market and are in doubt about how your home’s style will appeal to buyers, here are five home-decorating trends that real estate experts have identified as potential buyer turnoffs. Bryan and Jen Danger left their Portland, Oregon, home for about three years, first moving to British Columbia for Jen’s job and then enjoying a yearlong road trip south through Mexico and Central America. During that time, they got rid of most of their belongings and rented out their early-1970s home. “When we got back, we realized we wanted to be here a significant portion of the year but we couldn’t afford our mortgage, so we talked through the options,” Bryan says. “The garage became an ‘aha’ moment.” For some, the idea of a kitchen renovation is thrilling. They can't wait to get in there and rip out countertops, replace or paint cabinets, and choose shiny new finishes. Others just had a small anxiety attack upon reading the words "kitchen" and "renovation" together.

The idea of redoing a kitchen, especially if it involves demolition and you don't know what surprises await behind the walls, can be scary. And whether you're approaching a renovation with enthusiasm or something more closely resembling abject terror, you still want to make sure you get the value out. Those countertops might be gorgeous, but you'll probably love them even more if they bring in good ROI. Mosaik Design reports that the national average of an 83% ROI, and the best way to achieve the max is to "focus on kitchen upgrades that are energy-efficient, reasonably priced, and low-maintenance." That's especially important if you're looking to sell your home sometime soon. "If you have a dated kitchen…and a buyer walks into that kitchen, they're going to think that in order to redo that kitchen, they're going to have to spend $40,000 or $50,000," said US News. In reality, "the average cost of a minor kitchen remodel -- new cabinet doors, appliances, countertops, sink, faucet, paint and hardware" -- is $20,122 nationwide, according to the most recent Cost vs. Value report. "Savvy shoppers can do it for less than the buyer assumes." Even if you have no plans of selling soon, or ever, choosing the kitchen upgrades that can have the biggest impact on the look and function of your space while providing the best return on your investment is key. Put your money in the following areas to give you the best shot at both. Freddie Mac's latest Primary Mortgage Market Survey is reporting this week that the average fixed mortgage rate in the U.S. is moving slightly lower for the week helping to spur ongoing refinance activity.

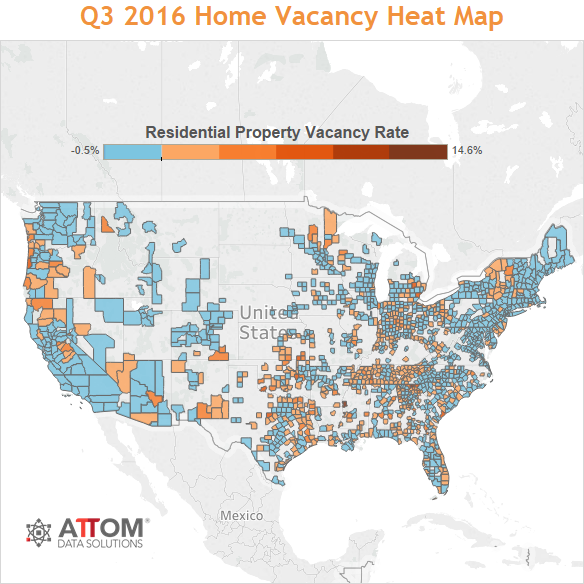

Sean Becketti, chief economist of Freddie Mac, "The 30-year fixed-rate mortgage fell 2 basis points to 3.44 percent this week. As mortgage rates continue to range between 3.41 and 3.48 percent, many are taking advantage of the historically low rates by refinancing. Since the Brexit vote, the refinance share of mortgage activity has remained above 60 percent." Click to continue reading at World Property Journal. U.S. Residential Vacancies Decrease 9% in Q3 2016 But Bank-Owned Vacancies Up 67% From a Year Ago9/7/2016 Vacant Homes in Foreclosure (Zombies) Down 9% From Year Ago; |

Tress RealtyTress Realty Group compiles some of the best real estate news, tips, and information for buyers, sellers and investors. Archives

April 2020

Categories

All

|

Home

Use of the information and data contained within this site or these pages is at your sole risk. If you rely on the information on this site you are responsible for ensuring by independent verification its accuracy, currency or completeness. It is provided “as is” without express or implied warranty.

Some properties which appear on this web-site may no longer be available because they are under contract, have been sold or are no longer being offered for sale. Images uses for navigation may be for properties in different towns, and are not intended to be considered anything other than representative of the types of houses that may be found in a particular municipality. All data and/or search facilities on this site are for consumer's personal, non-commercial use and may not be used for any purpose other than to identify prospective properties that consumers may be interested in purchasing.

Tress Realty Group cannot guarantee the accuracy of the IDX/MLS data created by outside parties. Tress Realty Group further assumes no responsibility for any misleading content or incorrectly listed information due to such negligence. All ancillary information presented on this web-site is not guaranteed and should be independently verified by the users of this site. Tress Realty Group makes no warranty, either expressed or implied, as to the accuracy of the data contained within or obtained from this web-site.

Tress Realty Group accepts no liability for any interference with or damage to a user’s computer, software or data occurring in connection with or relating to this Site or its use or any website linked to this site. Further, Tress Realty Group has provided Hypertext links to a number of sites as a service only. This should NOT be taken as implying any link between us and those various organizations or individuals.

Disclaimer: this website may be supported by ads and participation in affiliate programs. We may earn a commission when you click our links. The information included in this post is for informational purposes only and should not be taken as legal or financial advice.

Site copyrighted by Tress Realty Group LLC © 2016-2022, all rights reserved.

RSS Feed

RSS Feed