|

Insight from real estate broker Katrina Campins

0 Comments

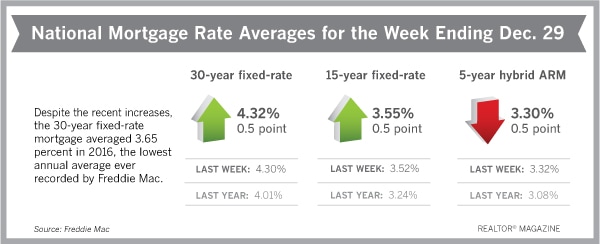

Though mortgage rates moved higher again this week, borrowers should still appreciate how low they are — because they're likely to increase further. Despite nine consecutive weeks of rises in mortgage rates, the annual average for the 30-year fixed-rate mortgage was 3.65 percent in 2016 — the lowest annual average ever recorded by Freddie Mac. "On a short week following the Christmas holiday, the 10-year Treasury yield was relatively unchanged," notes Sean Becketti, Freddie Mac's chief economist. "The 30-year mortgage rate rose 2 basis points to 4.32 percent, closing the year with nine consecutive weeks of increases. As mortgage rates continue to increase, home sales and affordability will continue to be a concern for housing in 2017." Freddie Mac reports the following national averages with mortgage rates for the week ending Dec. 29:

Source: realtormag.realtor.org

As a broker who's looking to position your company to remain competitive and relevant in 2017 and beyond, the suburban market is where you'll want to be.

The suburbs in the top 50 U.S. metro areas accounted for 91 percent of the population growth and 84 percent of the household growth between 2000 and 2015, according to the Urban Land Institute's report Housing in the Evolving American Suburb, which was released earlier this month. What's more, jobs increased by 9 percent in suburbs versus 6 percent in urban areas between 2010 and 2014. The suburbs are where most Americans live and work today, as well as where most residential and commercial development will be in greatest demand in the years ahead. Each financial decision is unique and depends on one’s goals. There are many considerations when it comes to your mortgage. Imagine, though, the lucky homeowners who are unconcerned with how to pay their mortgages, but how quickly they can eliminate them entirely. Surely no downside exists to paying off your mortgage early, right? Early Mortgage Payoff Considerations For some, eliminating their mortgage early will make financial sense, not to mention the emotional security it provides. In addition to the pros, however, there are potential cons that should be considered, including the following possible obstacles:

Let’s take a look at each consideration to help you weigh your options and decide if an early mortgage payoff could be right for you. Illiquidity Liquidity in finances refers to the ability to convert an asset—your baseball card collection, an heirloom, or your home—into cash. Illiquidity is the opposite: the inability to get cash when you need it, because all your cash is tied up in things. If time or circumstances would cause you to take a loss on liquidating an asset, the asset is illiquid. Normally, a mortgage is considered to be illiquid with one exception–a home equity line of credit (HELOC). The equity in your home is accessible quickly through a debit card or check, so you can borrow against that equity with minimal fuss. Suppose you unexpectedly have a leaky roof. A HELOC can provide you access to thousands of dollars at a low interest rate. If your other choice is to put $15,000 on your credit card for a roof replacement, it may make more sense to use your home’s equity and keep your unsecured debt (the credit card) low. If your mortgage is paid off and you want to use the equity in your home, you will need a new appraisal, loan origination fees, and other third-party expenses, plus one to two months for the loan to fund. You may not be able to spare that time if you’re in a bind. Revolving Debt A possible pitfall to eliminating a mortgage comes from diverting funds from other debt to pay off the mortgage. The mortgage at 4 percent interest is less expensive than a credit card debt with a 22 percent interest rate, if you’re only making the minimum payment. You may want to contemplate putting money toward the revolving debt before considering payments to eliminate the mortgage. Underfunded Retirement If you underfund retirement so your mortgage is eliminated early, you may not feel the effects of this decision for decades, but eventually you could feel it. One approach to eliminating your mortgage is to wait until after you have funded all your retirement accounts fully. You can borrow for most life events: weddings, renovations, home purchases, and even vacations. You cannot borrow for retirement and you may finish work one day and have no income other than your retirement savings and some modest government programs. The Tax Man Uncle Sam gives homeowners a gift every year in the form of deductions for mortgage interest. This is to encourage stable neighborhoods and high rates of home ownership. When your mortgage is eliminated early, so is that tax deduction. It is often the largest deduction taxpayers receive, and when eliminated, your tax liability may increase. Neglecting these important scenarios so you can eliminate your mortgage early may not be cost-effective. A careful, thorough examination in which you weigh all your options and needs with your financial advisor will help you determine whether early elimination of your mortgage is right for you. Source: pennymacusa.com

Research shows how to build and market properties that will appeal to the younger half of the boomer generation, which has different home buying preferences than their older counterparts.  What do buyers 55 and older want when purchasing a new home? If you’re a developer or broker-owner with salespeople focusing on this market niche, new research may be of interest to you. Hanley Wood, publisher of Builder magazine, and Taylor Morrison, a national home builder and developer, recently surveyed baby boomer home buyers, finding that the top three influences on their home purchases are location (50.2 percent), price (37.4 percent), and floor plan (19 percent). The study, conducted by The Farnsworth Group, also found that the three most important rooms in a home for this group are the kitchen (82.8 percent), master bedroom (59.2 percent), and great room (36 percent). The end of a year always has people wondering what the next will bring. And after a year like 2016 – with its political upsets, social uncertainty and international instability – many are desperately looking forward to a change in 2017.

Unlike other major points of discussion in the news, real estate maintained an overall positive trend throughout 2016, with home prices increasing 4.8 percent over the course of the year through November, according to real estate information site Zillow. Results from Zillow's most recent Home Price Expectations Survey of more than 100 economic and housing experts shows home values likely increasing by 3.6 percent in 2017 – continued growth, but slower than the past year. Real estate functions in a cycle – both seasonally and over several years – and 2017 isn’t expected to break that pattern in any significant way. However, the year will most likely lead us into a new curve of the cycle, with higher interest rates supported by faster wage and job growth than recent years. Many expect President-elect Donald Trump's administration to ease some lending restrictions, which would make it easier for lenders to issue mortgages, but nothing is certain in the lead-up to Inauguration Day. While we wait to see how policy changes may affect the real estate industry and homeownership, here are five things to expect from housing in 2017.  Housing styles emerge slowly and typically appeal first to cutting-edge architects, builders, and interior designers. As a trend spreads and gains wider interest, it may go mainstream, become almost ubiquitous, and eventually lose its star power. Just look at once-favored granite, which now has been replaced by the equally durable and attractive options of quartz and quartzite. The economy, environment, and demographics always play a big role in trend spotting. But this year there are two additional triggers: a desire for greater healthfulness and a yearning for a sense of community.  1. Community Gathering Spaces Why it’s happening: The combination of more time spent on social media and at work and the fact that fewer people live near their family members has caused many to feel isolated and crave face-to-face interactions. How it will impact you as a real estate pro: Multifamily buildings and even single-family residential developments are rushing to offer an array of amenity spaces to serve this need. Some popular options include clubhouses with spiffy kitchens, outdoor decks with pools and movie screens, fitness centers with group classes, and drive-up areas for food-truck socials. At its Main+Stone building in Greenville, S.C., The Beach Co. began hosting free monthly events such as its “Bingo & Brews.” Make sure you know which buildings, communities, and neighborhoods offer these sought-after social events and gathering spaces so you can help clients connect. If you're getting ready to move or sell your home, clutter is your worst enemy. It makes packing a nightmare, and finding the one item you need could take an extra 15 minutes to more than an hour. Decluttering is a great way to get rid of the things you don't need before moving or preparing your house for a walkthrough. But you need to avoid some of the common mistakes that come with this seemingly daunting job. Here are some of the roadblocks you could run into and how to handle them:

1. Laziness or procrastination If you don't feel like decluttering your house will achieve significant results or make your house feel cleaner, then you're not going to do it effectively. At the same time, if you drag your feet, it may take weeks to get the job done. Have a set goal in mind and stick to it when starting this project, especially if you plan to do the entire house. If you need someone to help or keep you on track, you can hire a home organizer to set a schedule and make the process more manageable.  In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers. Here are the top five reasons: 1. Exposure to Prospective Buyer A typical real estate agent's commission is 6 percent of a sale, according to industry experts. That 6 percent isn't always a windfall for the agent, who splits the money with perhaps a brokerage firm or another agent (since often there are two agents involved, the seller's and the buyer's). But it is a substantial chunk of change for a home seller. At 6 percent, if you sell a house for, say, $300,000, the seller will potentially end up handing over $18,000 to the real estate agents involved in both sides of the sale.

So naturally some home sellers opt to remove the agent from the equation. They sell the home on their own, a practice often referred to as an FSBO (for sale by owner), and some people even purchase homes without a real estate agent. Hovnanian CEO Ara Hovnanian on the increase in new home sales and why millennials don’t want to buy homes. With people away on trips and cold weather making house hunting less appealing, winter can be a challenging time to sell your home. On the other hand, fewer homes on the market means yours will get more attention from buyers. By upping the cozy factor, making the most of winter assets and paying attention to details, you can make your house really stand out.

Here are nine ways to prepare and stage your home for success, and create a warm and welcoming vision for buyers, even when the weather outside is frightful. 1. Have a cozy, crackling fire (or not) If you have a gas fireplace or new clean-burning woodstove, go ahead and light a fire to welcome visitors. But if your home's wood-burning fireplace is older and leaves a smoky smell in the room, hold off. Those with allergies or smoke sensitivities can be turned off — or literally turned away when they have to go outside. No fire? Consider offering warm apple cider instead. Planning to sell in the new year? Get a head start by listing early.Being early has its benefits: “The early bird catches the worm” or “Early to bed and early to rise makes a man healthy, wealthy, and wise.” You get the idea.

So if you’re thinking about listing your home for sale in Athens, GA, in 2017 — or if you already know you will — why not do so early, as in January or February? By getting in on the real estate market at the beginning of the year, you could benefit in some unexpected ways. Here are six of them. Home-builder confidence is at its highest level in years. But home building dropped 19 percent in the most recent month. These decreases come at a time when inventory levels are already severely constrained and many in the industry are calling for more new construction to alleviate shortages. With supply short and demand high, what is keeping builders from getting to work? Home builders say it's new regulations that are holding them back from filling the void. CNBC reports that such regulations may cost builders up to a quarter of the price of a new home, and a recent National Association of Home Builders study found regulatory costs have increased 29 percent in the past five years. The builders also say labor shortages are holding them back. Finally, prices for land and materials are rising and there is a lack of finished lots in neighborhoods where people want to live. These price constraints create an incentive for builders to construct fewer homes, because under such high demand, they can fetch higher prices for each home they do sell, CNBC reports. For now, builders remain happy with the market outlook. The NAHB released a survey last week showing builder sentiment at its highest level in 11 years. "Though this significant increase in builder confidence could be considered an outlier, the fact remains that the economic fundamentals continue to look good for housing," said NAHB Chief Economist Robert Dietz. "The rise... is consistent with recent gains for the stock market and consumer confidence. At the same time, builders remain sensitive to rising mortgage rates and continue to deal with shortages of lots and labor." Source: realtormag.realtor.org

As the year 2016 wraps up, one thing hasn't changed in the city's real estate market: affordability still eludes many New Yorkers. The average sale price for an apartment in Manhattan, including co-ops and condos, surpassed $2 million for the first time ever, according to City Realty, which predicts that 2017 will see average prices for condos drop for the first time in more than 5 years. But that's little consolation given that 2016’s average Manhattan apartment price was 91 percent higher than just 10 years ago, City Realty found. And rents are still pricey, even with many landlords offering a free month. Manhattan’s average price for a one-bedroom in November was $3,440 a month, according to a Douglas Elliman report. Since landlords often require you earn 40 times the monthly rent, that means you’d need to earn $137,600 a year to afford it. Here’s what experts are forecasting for 2017:  When you're moving, the last thing you need is a list of surprise fees tacked on at the end. Here's how to get an accurate estimate from the start. When planning a residential move, it’s important to have an accurate idea of the final moving costs so you can set a realistic moving budget. Estimating your moving costs, however, is not as simple as it seems at first.

The movers will provide you with an estimate based on the total weight of your shipment and the actual distance to your new home. But plenty of other factors can also affect the final price and make your relocation significantly more expensive than anticipated. To make a good financial plan for your upcoming move, you need to know exactly what can affect your moving estimate. When out-of-town patients used to travel to NewYork-Presbyterian Hospital, some would find that their best option for staying close to the hospital for early-morning surgery involved a trip over the George Washington Bridge from New Jersey.

Enter the Edge Hotel, a 54-room property that opened in the fall of 2015 in Upper Manhattan, an area with few other lodgings. As patients increasingly travel to and across the United States for medical treatment, developers are seizing on the benefits of situating hotels near major medical centers, many of which are in hotel-starved outskirts.  "Home Alone" is an all-time classic comedy about eight-year-old Kevin McAllister who must fight off burglars in his house when his family accidentally leaves him behind during Christmas break, Though the film never mentions exactly what Kevin's parents do for a living, it's safe to say that both the McAllister's would have had to be doing something pretty successful to afford a home as gorgeous and highly sought-after as this one. Located in the charming neighborhood of Winnetka, Illinois (about 20 miles north of Chicago), the famed McAllister home sits on a half acre with around 4,200 square feet of living space.  Even though rates spiked after the election and may rise further after the Fed meets December 14, there are about four million borrowers who will still benefit from refinancing, and of that, two million borrowers could save $200 or more per month by refinancing. There are many reasons to refinance, but here's what you should know before you act The home-purchasing process for foreign nationals isn't always smooth sailing. Chinese buyers are an undeniable growing force in American real estate, racking up over $300 billion in sales between 2010 and 2015.

Some are just looking to invest their money, but many are families drawn to the United States for a variety of reasons, including excellent schools and universities, lower cost of living (compared to Beijing and Hong Kong), and business opportunities in booming tech cities like San Francisco and Seattle. But buying property in the U.S. as a foreign national isn’t simple. Chinese buyers, just like any foreign citizen, face many challenges in the American real estate market — language and cultural barriers aside. For many, the quest to simply find the right resources and real estate agents to help them through the mortgage and purchasing process is the greatest hurdle. |

Tress RealtyTress Realty Group compiles some of the best real estate news, tips, and information for buyers, sellers and investors. Archives

April 2020

Categories

All

|

Home

Use of the information and data contained within this site or these pages is at your sole risk. If you rely on the information on this site you are responsible for ensuring by independent verification its accuracy, currency or completeness. It is provided “as is” without express or implied warranty.

Some properties which appear on this web-site may no longer be available because they are under contract, have been sold or are no longer being offered for sale. Images uses for navigation may be for properties in different towns, and are not intended to be considered anything other than representative of the types of houses that may be found in a particular municipality. All data and/or search facilities on this site are for consumer's personal, non-commercial use and may not be used for any purpose other than to identify prospective properties that consumers may be interested in purchasing.

Tress Realty Group cannot guarantee the accuracy of the IDX/MLS data created by outside parties. Tress Realty Group further assumes no responsibility for any misleading content or incorrectly listed information due to such negligence. All ancillary information presented on this web-site is not guaranteed and should be independently verified by the users of this site. Tress Realty Group makes no warranty, either expressed or implied, as to the accuracy of the data contained within or obtained from this web-site.

Tress Realty Group accepts no liability for any interference with or damage to a user’s computer, software or data occurring in connection with or relating to this Site or its use or any website linked to this site. Further, Tress Realty Group has provided Hypertext links to a number of sites as a service only. This should NOT be taken as implying any link between us and those various organizations or individuals.

Disclaimer: this website may be supported by ads and participation in affiliate programs. We may earn a commission when you click our links. The information included in this post is for informational purposes only and should not be taken as legal or financial advice.

Site copyrighted by Tress Realty Group LLC © 2016-2022, all rights reserved.

RSS Feed

RSS Feed