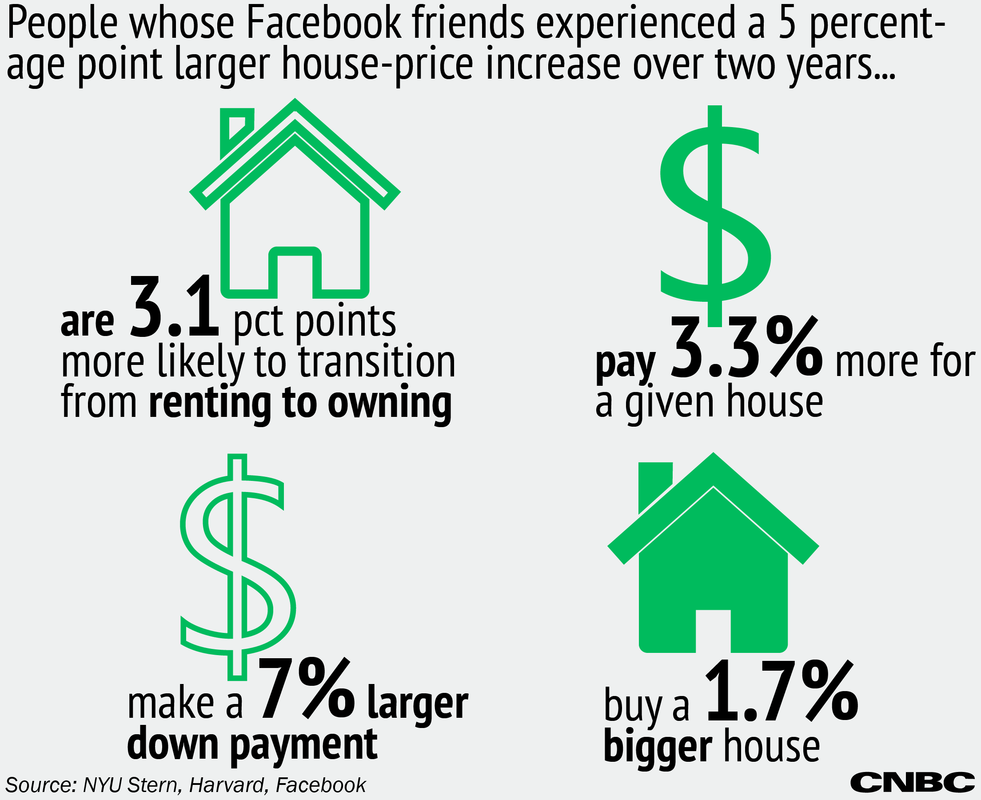

The findings may help explain how housing-market shifts can happen in different parts of the country, even when those areas are experiencing different economic conditions. Call it fear of missing out — on housing investments. Our decisions about buying property are heavily influenced by our social media networks, according to new research from economists at New York University, Harvard and Facebook. They found that people whose Facebook friends experience increases in house prices are far more likely to invest in property over the following two years. The researchers set out to study whether a person's social media network would influence their housing investment decisions, and if those decisions could show an effect on local housing markets in aggregate. On both counts, the research suggests a significant impact. That's taking into account aspects like income, one of the main factors of house-price dispersion.  A person who is currently renting and whose Facebook friends saw their homes appreciate 5 percent more than the market average in the past two years is 3.1 percentage points more likely to buy a home themselves in the next two years. The researchers also found that people are more likely to buy a larger house, pay more for a given house and make a larger downpayment. "We were relatively certain that we'd see some effect," said Johannes Stroebel, professor at NYU's Stern School of Business. "What we didn't know was how large that effect would be." The paper's co-authors are Stroebel, Facebook economist Michael Bailey, Ruiqing Cao of Harvard and Theresa Kuchler, also of NYU's Stern. The researchers first analyzed a survey of 1,242 Facebook users from the Los Angeles area. Respondents were asked how often they talked to friends about investing in the housing market and what they thought of the attractiveness of property investments in their local area. Even when controlling for different individual characteristics, the researchers found a strong correlation between Facebook users who had strong network connections in areas that had seen large housing-price increases and their interest in property investment in their own area. That part of the study is not a huge surprise. If your friend finds a great investment and lets you know about it, of course you'll want to explore the opportunity for yourself. As Stroebel said, "If your friends are in Chicago and my friends are in Boston, and Chicago sees house prices increase, you're going to be more optimistic about buying a house than me." What's more interesting is the next step in the research: By matching anonymized Facebook data to housing-transaction data from around the country, the researchers found that individuals could be influenced by distant house-price fluctuations to buy and sell property in their hometown. In the end, the sample included around 1.4 million individuals and over half a million housing transactions. The findings go a long way to help explain how housing-market shifts can happen in different parts of the country, even when those areas are experiencing different economic conditions. Half the size of the effect of having a child"When Chicago house prices go up compared to prices in Boston, the person with friends in Chicago is not only more optimistic," Stroebel said, "but they're more likely to buy a house." Again, people whose friends saw a 5 percent appreciation over a two-year period were 3.1 percentage points more likely to buy a house of their own over the following two years. To put that in perspective, that increased likelihood is about half the size of the effect of having a child — one of the major life events that people typically tie to house ownership. They also buy a 1.7 percent larger house, pay 3.3 percent more for a given house and make a 7 percent larger downpayment, the researchers found. The last section of the research suggests that these individual decisions, which are influenced by a person's social network, can come together in aggregate and actually affect the housing market as a whole, observable at the county level. The researchers looked at data of house prices and trading volume in 831 counties from 1998 to 2012 along with information on the Facebook networks of residents. Again, they found that a higher degree of positive housing-market experience meant increases in price and trading volume. To strengthen their conclusions, the researchers also looked at the inverse: What happens to people whose friends live in areas that see declines in the housing market? Those people are more likely to go from owning property to renting, will sell that property at a lower price and are overall less likely to take risks on the housing market. A similar trend is seen in the aggregate. So what's going on here? By controlling for different demographic characteristics, researchers said they discovered it's not just groups of people coming of age at the same time. Likewise, clustered occupations are controlled for, so positive shocks to a certain industry (e.g., tech) are accounted for. "I think this is leading to that sense of envy and what the millennial generation calls 'fomo,' or 'fear of missing out,'" Lawrence Yun, chief economist with the National Association of Realtors, said of the study. "If someone's friends are doing well, they fear they're missing out and they want to be more active in the home-buying process." But it's not just about "keeping up with the Joneses," Stroebel said, pointing to the initial survey that showed Facebook users who viewed housing as a good investment. It's more likely that a network's collective experience shows them that real estate can be a good investment, as long as that experience is coming from people they trust. "Real estate is a major expenditure, so it's not about buying chewing gum or penny stocks," Yun said. "The trust factor ingrains a person to say, 'Yeah, buying real estate is something I should seriously consider.'" Social media pushing stocks? Stroebel cautioned that it was too soon to extend their findings to other investment areas, but there's a growing field of literature studying how people's social interactions affect economic behavior. A previous study pointed to commonalities among investment decisions for mutual fund managers who live near each other, for example. The next step is to look at the world of online social interactions, best encapsulated by social media networks. "For us, this is just the beginning to see how social networks and social interactions have an effect on economic decisions," he said. "But in the next few years, I hope we'll be able to look at other markets to see social networks' effects." Source: CNBC

1 Comment

3/25/2022 12:03:00 am

This is a fascinating study. It's a new discovery for me that these individual decisions, influenced by a person's social network, can aggregate and affect the housing market as a whole.

Reply

Leave a Reply. |

Tress RealtyTress Realty Group compiles some of the best real estate news, tips, and information for buyers, sellers and investors. Archives

April 2020

Categories

All

|

Home

Use of the information and data contained within this site or these pages is at your sole risk. If you rely on the information on this site you are responsible for ensuring by independent verification its accuracy, currency or completeness. It is provided “as is” without express or implied warranty.

Some properties which appear on this web-site may no longer be available because they are under contract, have been sold or are no longer being offered for sale. Images uses for navigation may be for properties in different towns, and are not intended to be considered anything other than representative of the types of houses that may be found in a particular municipality. All data and/or search facilities on this site are for consumer's personal, non-commercial use and may not be used for any purpose other than to identify prospective properties that consumers may be interested in purchasing.

Tress Realty Group cannot guarantee the accuracy of the IDX/MLS data created by outside parties. Tress Realty Group further assumes no responsibility for any misleading content or incorrectly listed information due to such negligence. All ancillary information presented on this web-site is not guaranteed and should be independently verified by the users of this site. Tress Realty Group makes no warranty, either expressed or implied, as to the accuracy of the data contained within or obtained from this web-site.

Tress Realty Group accepts no liability for any interference with or damage to a user’s computer, software or data occurring in connection with or relating to this Site or its use or any website linked to this site. Further, Tress Realty Group has provided Hypertext links to a number of sites as a service only. This should NOT be taken as implying any link between us and those various organizations or individuals.

Disclaimer: this website may be supported by ads and participation in affiliate programs. We may earn a commission when you click our links. The information included in this post is for informational purposes only and should not be taken as legal or financial advice.

Site copyrighted by Tress Realty Group LLC © 2016-2022, all rights reserved.

RSS Feed

RSS Feed