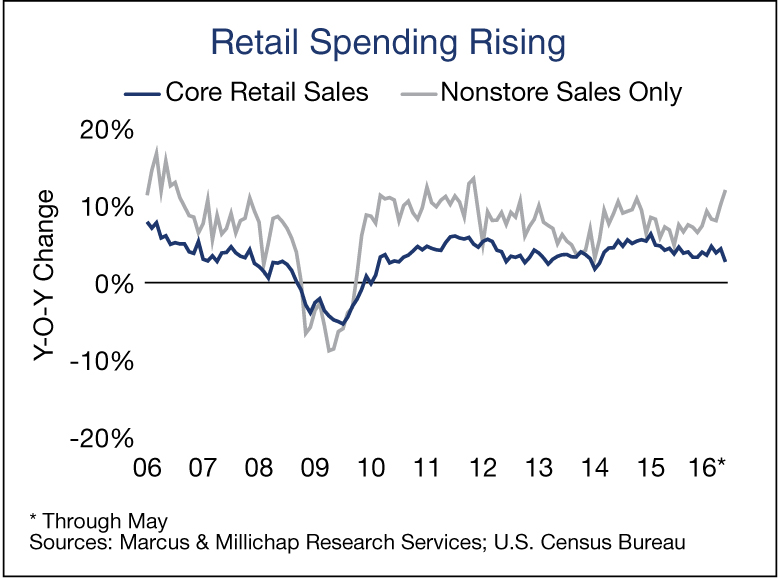

Source: Marcus & Millichap

1 Comment

Leave a Reply. |

Tress RealtyTress Realty Group compiles some of the best real estate news, tips, and information for buyers, sellers and investors. Archives

April 2020

Categories

All

|

Home

Use of the information and data contained within this site or these pages is at your sole risk. If you rely on the information on this site you are responsible for ensuring by independent verification its accuracy, currency or completeness. It is provided “as is” without express or implied warranty.

Some properties which appear on this web-site may no longer be available because they are under contract, have been sold or are no longer being offered for sale. Images uses for navigation may be for properties in different towns, and are not intended to be considered anything other than representative of the types of houses that may be found in a particular municipality. All data and/or search facilities on this site are for consumer's personal, non-commercial use and may not be used for any purpose other than to identify prospective properties that consumers may be interested in purchasing.

Tress Realty Group cannot guarantee the accuracy of the IDX/MLS data created by outside parties. Tress Realty Group further assumes no responsibility for any misleading content or incorrectly listed information due to such negligence. All ancillary information presented on this web-site is not guaranteed and should be independently verified by the users of this site. Tress Realty Group makes no warranty, either expressed or implied, as to the accuracy of the data contained within or obtained from this web-site.

Tress Realty Group accepts no liability for any interference with or damage to a user’s computer, software or data occurring in connection with or relating to this Site or its use or any website linked to this site. Further, Tress Realty Group has provided Hypertext links to a number of sites as a service only. This should NOT be taken as implying any link between us and those various organizations or individuals.

Disclaimer: this website may be supported by ads and participation in affiliate programs. We may earn a commission when you click our links. The information included in this post is for informational purposes only and should not be taken as legal or financial advice.

Site copyrighted by Tress Realty Group LLC © 2016-2022, all rights reserved.

RSS Feed

RSS Feed